Introduction

The world of finance is in the midst of a major transformation. At the center of this shift is tokenization—a powerful concept that’s turning traditional investing on its head. By converting real-world assets into digital tokens on the blockchain, tokenization is opening up access to markets that were once the exclusive playground of institutions and the ultra-wealthy.

It’s not just a buzzword. It’s a technological leap that’s democratizing ownership, increasing liquidity, and making the financial system more transparent and efficient. And Republic is leading the way, with its latest initiative offering retail investors access to top private companies—including companies like SpaceX—for everyday investors. This is made possible through Mirror TokensTM, a novel way to gain exposure to the potential upside of private companies. Mirror TokensTM are structured as debt securities, with payouts tied to a qualifying event such as an IPO or acquisition—all made possible through tokenization.

Let’s take a closer look at how tokenization works, why it matters, and how Republic is helping shape the future of finance.

What is Tokenization?

At its core, tokenization is the process of turning an asset—physical or intangible—into a digital token on a blockchain. These tokens represent ownership or a stake in something of value: a building, a piece of art, a company, even intellectual property.

Because blockchain technology is secure, transparent, and easily programmable, tokenization allows for fractional ownership, seamless transfers, and real-time digitally native record-keeping. For example, a $1 million apartment can be tokenized into 1,000 shares thereby letting everyday investors own a slice for $1,000 instead of needing the full million.

Why Tokenization Matters

Tokenization isn't just a new way to invest but a better way as it permits the following:

Fractional Ownership: High-value assets become accessible to more people, broadening the investor base.

Global Accessibility: Investors from anywhere in the world can participate with just an internet connection.

Enhanced Transparency: Blockchain’s public ledger increases trust and reduces fraud.

Efficiency via Automation: Smart contracts streamline compliance, payments, and more.

Regulatory Control: Programmable rules help ensure tokens follow compliance frameworks.

Secondary Market Potential: Tokens can be designed for future tradability, opening the door to liquidity through secondary markets—something traditional private investments rarely offer.

Unique Perks: Token holders might receive dividends, special access, or other ownership benefits.

Real-World Applications of Tokenization

We’re already seeing tokenization transform how people own, invest in, and interact with various types of assets:

Real Estate: Easier property investment and automated income distribution.

Commodities: Transparent trading of tokenized gold, silver, oil.

Art & Collectibles: Fractional ownership of rare or high-value items.

Luxury Goods: Authentication and investing in watches, jewelry, and cars.

Cultural Assets: Ownership of sports teams or films with VIP perks.

Intellectual Property: Artists can offer fans a share in licensing revenues.

Industry Momentum: Tokenization Is Going Mainstream

Major financial players are now embracing tokenization, validating its long-term potential:

BlackRock, Goldman Sachs, and JPMorgan are investing in tokenized bonds, real estate, and cash products.

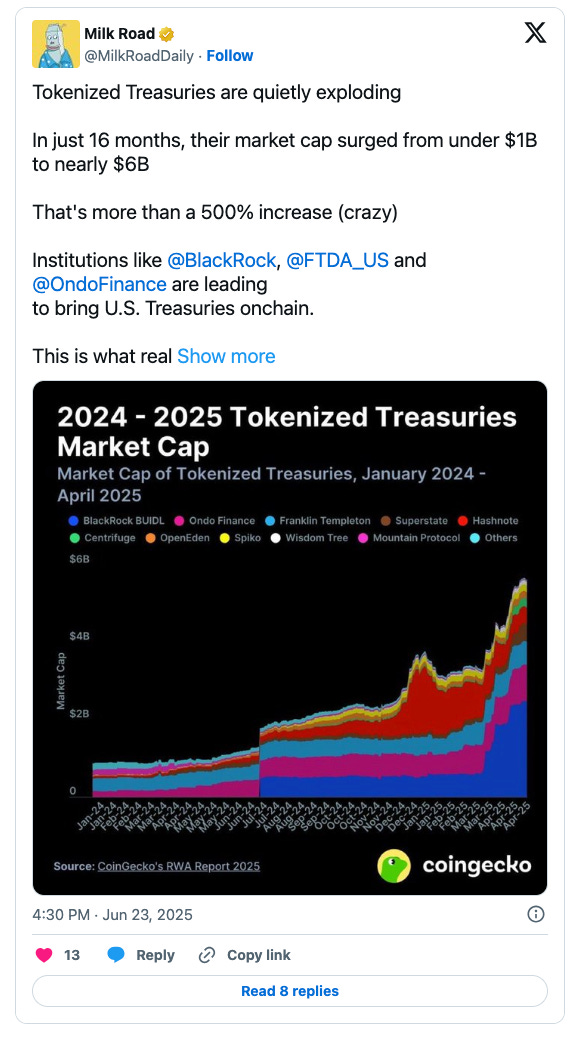

Ondo Finance and Maple Finance are bringing tokenized U.S. Treasuries to the blockchain, and they are not the only players doing so.

Source: X The largest stablecoin issuer is working to enable the “tokenization of everything,” managing over $125 billion on-chain

Source: X Tokenized gold is gaining traction as a digital hedge against inflation

Source: X Tokenized stocks on Kraken & Robinhood (only available outside the US).

According to a recent report by Security Token Market, tokenized assets could represent $30 trillion in asset tokenization by 2030, with stocks, real estate, bonds, and gold leading the way.

Republic: Pioneering the Tokenization Frontier

While many are exploring tokenization, Republic is already delivering it by building the infrastructure, compliance framework, and partnerships that bring real-world assets on-chain and into the hands of everyday investors.

From sports and cinema to entertainment IP, Republic is helping brands and creators tokenize ownership in ways that are accessible, secure, and tradable—all while navigating the regulatory landscape with precision.

Notable Tokenization Projects:

Pressman Film: Stakeholding in projects like Wall Street and American Psycho, allowing fans to back and benefit from cinematic success.

Eli Roth’s Horror Studio: A tokenized stake in a new horror studio from acclaimed filmmaker Eli Roth—known for Hostel, Cabin Fever, and Thanksgiving—giving fans unique access to the world of genre filmmaking through blockchain-enabled ownership.

Mirror Tokens™: A New Way for U.S. Investors to Access Private Markets Under Reg CF

The latest and the first of its kind is Republic’s launch of Mirror TokensTM offered by RepublicX—the innovation arm focused on bringing tokenization, including RWAs.

Mirror TokensTM offers a first-of-its-kind way to gain exposure to top private companies like SpaceX, Anthropic, Epic Games, and most recently OpenAi—not by trading actual shares, but through tokens that represent debt interests in RepublicX itself but which provides a similar prospective upside in those companies.

These tokens are offered under the Reg CF exemption, which opens the door for U.S. retail investors to participate. With the right infrastructure and regulatory foundations in place, Mirror TokensTM help democratize access to private markets, thus making the experience feel much more like trading public stocks.

Andrew Durgee, co-CEO of Republic, explains:

“We’re talking about delivering products to retail investors that they’ve been held out of previously. The fact that retail investors couldn’t own top private companies like SpaceX has always been crazy to us. Now that’s going to be attached to the upside of these top private businesses. The businesses that we target out of the gate we want to have a retail focus, or at least significant retail following.”

This isn’t just a tech milestone but a testament to Republic’s drive to be the first to cut through the legal and regulatory red tape and bring to the everyday investors access to unprecedented opportunities that were once out of reach for many.

Readers interested in reading more about this can do so here.

Looking Ahead: Tokenization Is Reshaping Finance

Tokenization has moved well beyond theory, it's now a full-scale movement redefining how assets are owned, traded, and experienced. As the technology matures, we’ll see deeper integration into everyday life: from woven utilities that embed tokens into digital interactions, to AI-powered engagement that personalizes relationships between investors and issuers.

At its core, tokenization is about one thing: unlocking access. And with the launch of the Mirror TokensTM, Republic has proven it's not just keeping up but it's leading the charge. By breaking through regulatory barriers and opening doors to opportunities like top private companies SpaceX shares, Republic is setting a new standard for what financial inclusion can look like in a tokenized future.

About Republic

Republic accelerates the growth of Web3 by supporting the industry’s most ambitious projects and investors. With a world-class team of strategists, the Republic Research arm guides projects from seed to liquidity, offering expertise in tokenomics, smart contract development, fundraising, and marketing. Its platform also includes global token offerings, institutional crypto funds, and enterprise-grade solutions for Web3 startups. Republic Research has played a key role in the success of projects such as Avalanche and Supra, among others. As part of the Republic ecosystem, which has deployed over $2.6 billion across 150 countries, Republic Research is a leader driving innovation in the Web3 space.

Republic Research collaborates with the most promising Web3 projects to drive growth, innovation, and establish a leadership position in the industry. If you're ready to take your venture to the next level, reach out to us today!

Disclaimer

The content of this article is for informational purposes only and should not be considered financial, investment, or legal advice. Investing in cryptocurrency projects involves a high degree of risk, including the potential loss of all invested funds. The views expressed are those of the author and do not necessarily reflect the opinions of Republic. Readers should perform their own due diligence and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Cryptocurrency markets are highly volatile, and regulatory environments are subject to change. Always invest responsibly.