An abridged version of The Super Token Thesis was originally published by Hackernoon. You can read it here.

Dogecoin. BitTorrent. Shiba Inu. Supporters lovingly refer to them as Altcoins. Pejoratives have a more notorious name in mind: Shitcoins.

Welcome to the era of pump-and-dump, where at least one new Shitcoin (or multiple) pops up every single day. In 2021 alone, 8,070 new coins were created, a literal doubling of the entire token space since 2008 within a single year. While it was once impossible to imagine a world where Netizens managed dozens of utility tokens in their everyday life, the current Web3 paradigm has created this new reality.

In such an era of coin proliferation, intention becomes irrelevant, sustainability a focus. The most unanimous issue that Shitcoins face is their lack of any kind of discernable purpose. Then, there are its short-term price increases coupled with immediate price plummets. This intentional volatility perpetuates the vicious cycle where founders look for the next cash cow to prey upon, and investors try to outsmart the next fool.

Current bear market sentiment coupled with impending regulations has made it quite clear that such volatile coins need to be eradicated. If not, they pose a significant risk of leaving a permanent black mark on the legitimate concept of Tokenomics. Thus, our solution of Shitcoin Minimalism is proposed, where our main focus shifts to how we can get the fewest tokens to accomplish the most.

Far too often are there projects like social token generation platforms and convoluted GameFi/DeFi ponzis that seek to pump useless tokens into the market. The social token platform generally postures that either subcommunities or celebrities/artists should be able to create new tokens that allegedly help “monetize” their fanbase, only to essentially generate helpless debt notes with bleak (if not nonexistent) horizons for future cash flows. By scattering the value proposition across several centers of gravity, this effectively kills any chance for a token to achieve network effects and meaningful liquidity. We like to call this phenomenon “ownership fetishism”, where the narrow pursuit of individual attention and success comes at the expense of broader adoption, accessibility, and sustainability. To tackle this, we propose that a conglomeration of sufficiently aligned celebrities or subcommunities band together towards the adoption of a common currency. This way, user activity can seamlessly flow between them in a larger economy, as opposed to the current model of irrelevant hermit kingdoms.

Similarly, we’ve seen countless GameFi/DeFi platforms that try to unnecessarily convolute their economies by creating multiple Shitcoins from scratch. We’ve even seen nightmares where projects will attempt to build their own proprietary stablecoin, volatile utility, and even a separate governance token sitting in the corner of the room wearing its hat on its ass and its shoes on its head. The rationale: to allow for multiple tokens to occupy increasingly narrower use cases. The only conceivable reason why projects have even attempted this is to gamble on not one, but two tokens to ride a bull market wave. Instead, we posit that 1) there is no reason to reinvent a stablecoin when you can tap into existing stablecoins or their aggregators, and 2) it makes no sense that, even if there are eager and diligent governors, that they should be compensated in a currency different from the one they’re responsible for managing.

Entertaining the logic that consolidation can lead to greater adoption, the question becomes: which few tokens can survive? In our eyes, only those that can monopolize user attention, and integrate as many use cases and utilities to fit a culturally cohesive user narrative.

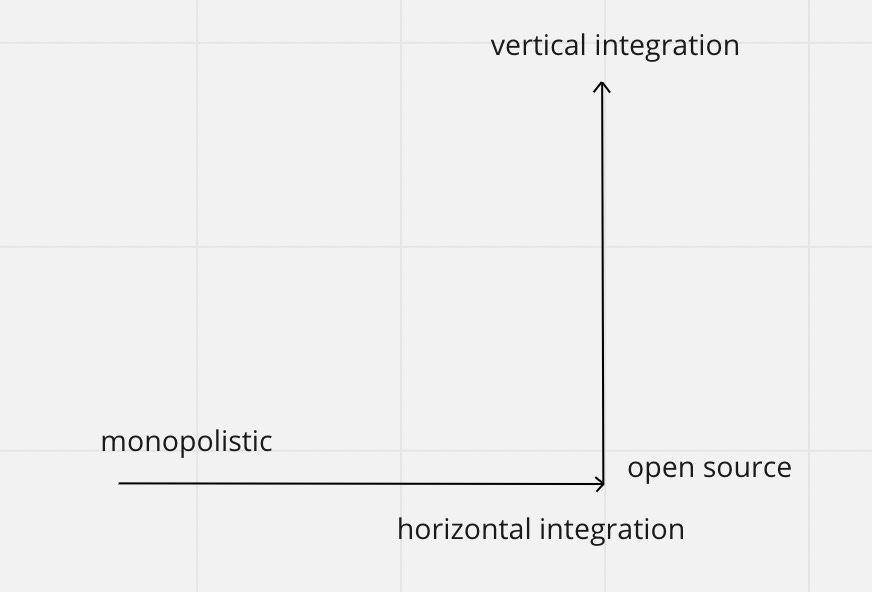

As its name implies, the Super Token will effectively function as a one-token-fits-all; in many cases, we imagine it will be highly geographic in its late-stage adoption. Two broad solutions have arisen where the Super Token may be implemented. As seen in the below diagram, we have illustrated a two-by-two table featuring: Vertical Integration vs. Horizontal Integration, and Monopolistic vs. Open Source.

The first issue that is raised is integration. A vertically-integrated structure involves an acquisition of a company operating in the production process of the same industry, while a horizontally-integrated structure involves a takeover of a company operating at the same level in a set industry.

The next issue we must examine is ecosystem. In a traditional monopoly, an identifiable monopolist would acquire leverage to provide a strong real estate opportunity for other horizontally/vertically integratable partners. This would leave new developers with the choice of either developing within an existing monopolist framework in exchange for economic sharing, or a subjection to one of the most savage forms of competition in an entrepreneurial market.

Countering this, we have an open-source ecosystem. In such an environment, power is given not to an alliance of figureheads, but to the people. We aim to establish such democracy through an internal governance structure conducted entirely by DAOs. Through a combination of smart contracts and staking mechanisms, decisions and changes of hands will be voted upon on the immutable blockchain ledger for the public to witness.

Our excitement lies closer to the open-sourced Super Token. This would take form in the Super App, which will provide a framework for open dialogue, tech development, value exchange, and distribution, which not only helps users of all member projects easily navigate their experiences, but also drastically reduces the cost of project development (economies of scale reduces marginal cost). The goal: how do we achieve the scale and user retention of a SuperApp like Wechat (for other regions, think Rappi, Kakao, and Revolut who are not demonstrated monopolies yet, but have potential), while still preserving the equitability of a multi-party ownership structure? Completely open-sourced, the SuperApp would effectively operate as a multichain API wrapper running on top of multiple L1s. Similar to WeChat’s mini-programs, these APIs can be thought of as sub-programs within the SuperApp, where each API would ideally use the Super Token as its native currency.

The fundamental incentive a potential API player has to fly under the wing of another (or potentially multiple) Super Token is bootstrapped distribution and de-risking. Why put in all the operational and capital expense to silo user attention, only to fall short at the hands of first-movers or Web2 incumbents? With Super Tokens and their Super Apps, a distribution platform and token performance is offered that can be piggybacked on for adoption. If you end up garnering a loyal following, even in the worst case scenario you could spin out again to be your own Super Token candidate.

This concludes our first section: “The Dream.” The more tokens users have to manage, the harder they become to use. Under a Super Token structure, talented product teams can ship to market and iterate faster, with less pump-and-dump doomsday scenarios and risk of falling into obscurity for eternity. In the long run, this will greatly enhance the overall usability of Web3 infrastructure, as well as eliminate the many unnecessary financial losses of its projects and their users.

Part II of The Super Token Thesis drops soon: INFRASTRUCTURE. Stay tuned…