Introduction

Ethereum (ETH) stands at a pivotal moment in its evolution. Once seen primarily as the programmable backbone of decentralized finance (DeFi) and smart contracts, ETH is now making headlines for a new role: reserve currency for private enterprises. This shift, driven by both technological advances and bold corporate moves, signals a profound transformation in how digital assets are perceived and utilized in the global financial system.

In this piece, we unpack how Ethereum’s role is changing—from balance sheet strategy and staking economics to ETF inflows, stablecoin dominance, and Layer 2 fragmentation. We also explore what this shift means for ETH’s long-term value and how institutions are responding.

From Asset to Reserve: The SharpLink Catalyst

The most recent striking news in the Ethereum ecosystem has been gaming firm SharpLink’s announcement of a $425 million ETH reserve. By not only acquiring a massive ETH position but also installing ConsenSys founder Joseph Lubin as board chairman, SharpLink reframed Ethereum to a strategic reserve asset.

The company’s move—mirrored by others like BioNexus Gene Lab and BTCS Inc—is more than a balance sheet maneuver; it’s a signal of ideological alignment with Ethereum’s vision of the future. After publicly announcing the acquisition, the company had a 472% rise in its marketcap.

However, SharpLink’s approach goes beyond holding ETH. By staking its holdings, the company participates in Ethereum’s proof-of-stake consensus, earning yield and further reducing ETH’s circulating supply. This mechanism, unavailable to Bitcoin holders, transforms ETH from a passive store of value into an active, yield-generating reserve. This is reminiscent of Bitcoin’s rise as a sovereign reserve, but ETH’s programmability and staking yield introduce a new dimension. Companies are not just storing value—they’re participating in the network’s security and earning returns.

Market Validation and Institutional Demand

ETH’s new status as a reserve currency is being validated not just by private firms but also through asset management institutions. US spot Ethereum ETFs have seen strong inflows, with BlackRock’s iShares Ethereum Trust leading the way.

Major banks and investment houses are increasingly viewing ETH as both a store of value and a productive asset, with some analysts even describing it as “fundamentally mispriced” given its robust on-chain activity and growing adoption. But what’s driving this surge of institutional interest in ETH now? The answer goes beyond simply following Bitcoin’s reserve playbook—it lies in Ethereum’s unique ability to power the next generation of DeFi applications and stablecoin innovation, setting the stage for a broader transformation in institutional finance.

How are institutions catching on?

Crypto funds saw $785 million in inflows over five weeks, with Ethereum accounting for $205 million—its strongest showing of the year.

CoinShares also reports that Ethereum leads with $296.4m in inflows—marking its strongest run since December 2024.

Powering DeFi and Institutional Stablecoin Adoption

Ethereum has firmly established itself as the foundation of DeFi and the premier platform for stablecoin activity. In April 2025, Ethereum’s on-chain stablecoin transaction volume reached an all-time high of $908 billion, driven primarily by USDC, USDT, DAI, and emerging institutional stablecoins like USD1. This record-setting figure reflects both strong institutional adoption and the integration of stablecoins into mainstream payment solutions by companies such as Meta and Stripe.

As stablecoins continue to mature and gain mainstream acceptance, the next wave of institutional adoption is poised to unfold within the DeFi sector—and Ethereum is uniquely positioned to lead this transformation.

Currently, Ethereum leads as the dominant chain for DeFi, with over $67B in total value locked (TVL) according to DefiLlama.

Ethereum also dominated in the market of real-world asset (RWA) TVL, with $9.78 billion locked—making up the majority of the $12B + held across DeFi (see chart below):

One of Ethereum’s most significant innovations is its staking model, which allows companies and institutions to actively participate in network security while putting their assets to work. This transforms ETH from a passive holding into a productive asset, aligning the interests of investors, enterprises, and the network itself. Staking not only enhances security but also encourages long-term engagement from institutional participants.

BlackRock, one of the world’s largest asset managers, has recently shifted a significant portion of its crypto portfolio—moving over $560 million worth of Bitcoin to Coinbase and purchasing approximately $95 million in Ethereum. This aligns with the SEC’s announcement that staking services do not constitute securities, which has removed a major source of uncertainty for institutions. As more traditional finance and fintech giants embrace Ethereum for its programmability, compliance, and maturing ecosystem, the network is experiencing record levels of usage across key sectors.

To support this institutional interest, the Ethereum Foundation has launched the Trillion Dollar Security (1TS) initiative, focused on auditing and upgrading the Ethereum stack to ensure it can safely secure institutional-scale capital.

Together, these developments point to a maturing narrative: Ethereum is no longer just a platform for innovation—it’s positioning itself as institutional-grade infrastructure, ready to support trillions in digital assets.

ETH’s Recent Price Rally and On-Chain Momentum

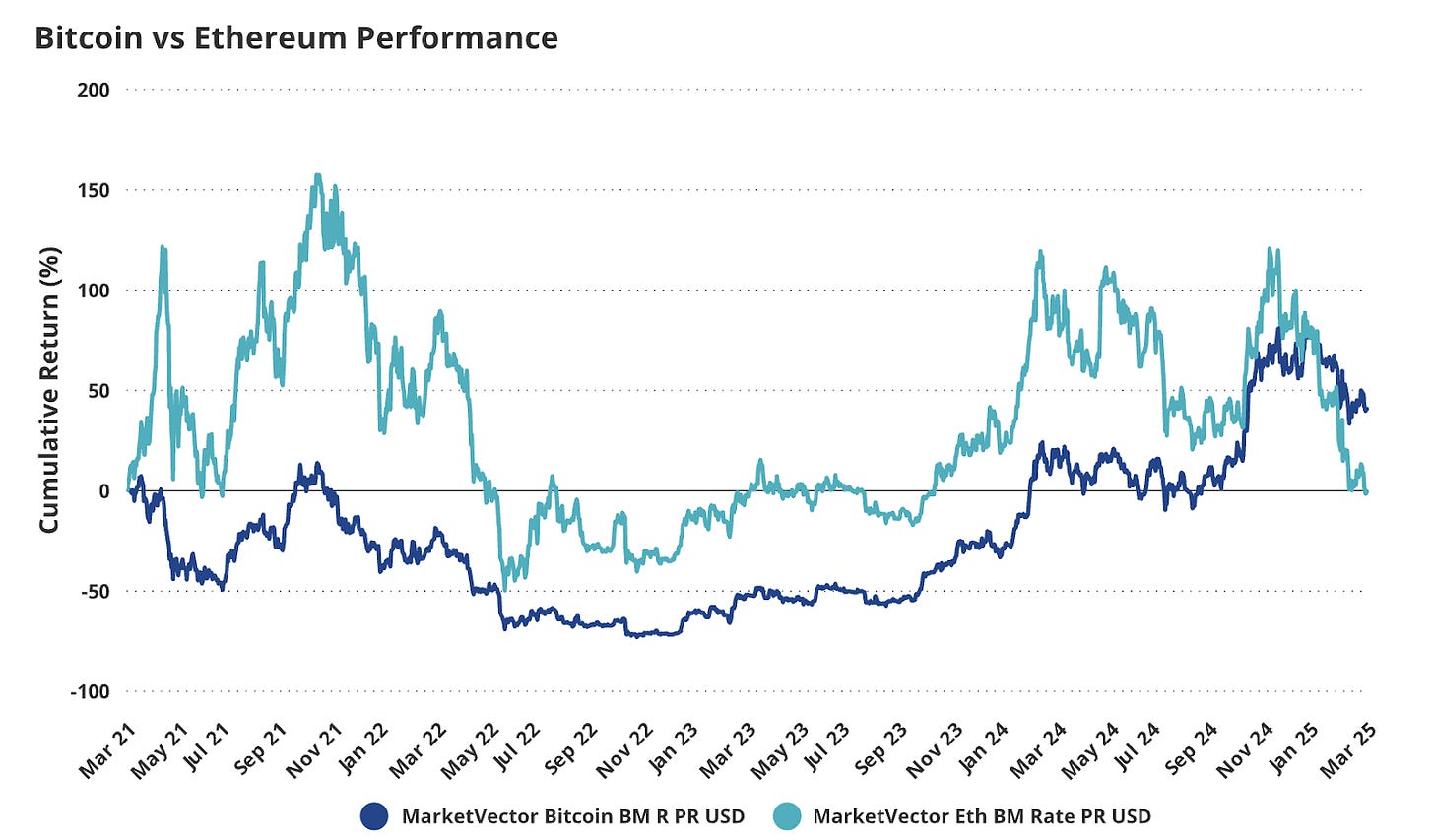

While ETH has rallied sharply in recent weeks, it’s worth noting that Ethereum has lagged behind Bitcoin in price performance for much of the past two years. According to data from VanEck (see chart below), following the 2021 bull market, Bitcoin recovered faster amid institutional ETF approvals and global macro uncertainty. Ethereum, meanwhile, fell behind—dropping approximately 50% by early 2025, while Bitcoin remained more resilient.

However, the past few months mark a potential shift: Ethereum has begun to outperform Bitcoin—gaining nearly 30% over two sessions ending May 9, according to CryptoSlate—following a prolonged downtrend in the ETH/BTC pair since 2022.

This price action appears to be reinforced by on-chain data, which points to a broader shift in sentiment:

ETH supply on centralized exchanges has dropped to a 10-year low of just 4.9%, according to Santiment, while CryptoRank data shows that over 1 million ETH has been withdrawn in the past month alone.

Whale wallets (holding over 10,000 ETH) have accumulated 450,000 ETH since late April (see X post below), now controlling over 40.75 million ETH.

These movements further indicate that major holders are shifting ETH into long-term storage or staking, reducing liquid supply and signaling confidence in future price appreciation.

Ethereum’s Fragmentation Issue

The rapid adoption of Layer 2 (L2) solutions—such as Arbitrum, Optimism, and Base—has been instrumental in scaling Ethereum, drastically reducing transaction costs and increasing throughput across the ecosystem. However, this success has introduced a new set of challenges: liquidity fragmentation and weakened value accrual to Ethereum’s base layer. With over 50 L2s now live or in development, users and capital are increasingly dispersed across isolated networks, making the Ethereum ecosystem feel more like a maze of separate chains than a unified platform.

Liquidity fragmentation presents significant hurdles for both users and developers. For users, interacting with DeFi protocols often means navigating multiple networks, bridging assets, and managing additional transaction steps—each introducing friction, delays, and potential security risks. For developers, the need to support and maintain applications across several L2s adds complexity and raises operational costs, diverting resources from innovation to infrastructure management. As a result, capital becomes trapped in silos, reducing overall market efficiency and making it harder for DeFi protocols to maintain deep, unified liquidity pools.

This fragmentation also impacts Ethereum’s economic model. As more transaction execution moves off-chain to L2s, a smaller share of transaction fees and value accrues to Ethereum’s mainnet. While L2s periodically settle batches of transactions on Ethereum, the majority of fees and MEV (maximal extractable value) are retained by the L2s themselves rather than flowing back to ETH holders or validators. This shift has sparked debate over whether Ethereum’s long-term value proposition could be undermined if incentives for securing and maintaining the base layer diminish.

Despite these challenges, the assets locked across L2s—over $25 billion as of April 2025—represent untapped potential. Industry efforts are now focused on developing interoperability standards, cross-chain liquidity layers, and abstracted user interfaces to help unify the ecosystem. Solutions such as ERC-7683 and new cross-chain protocols aim to make it easier for users and capital to move seamlessly between L2s, reducing friction and unlocking greater utility from existing assets. Ultimately, addressing these fragmentation issues will be crucial for sustaining Ethereum’s leadership in DeFi and ensuring that both value and incentives continue to flow throughout the ecosystem.

ETH as the New Reserve Asset of Wall Street

Ethereum’s evolution from a programmable blockchain to a reserve currency for tech companies marks a new chapter in digital finance. As more firms follow SharpLink’s lead—staking, integrating, and signaling allegiance to Ethereum’s protocol—the reflexive feedback loop is likely to accelerate. This is not just a financial trend, but a shift in how capital “votes” for the protocols that will underpin the next era of the internet.

In 2021, such moves might have been dismissed as speculative pumps. In 2025, they represent a new financial signaling language—one where protocol allegiance, not just earnings, defines corporate strategy and market value.

About Republic

Republic accelerates the growth of Web3 by supporting the industry’s most ambitious projects and investors. With a world-class team of strategists, the Republic Research arm guides projects from seed to liquidity, offering expertise in tokenomics, smart contract development, fundraising, and marketing. Its platform also includes global token offerings, institutional crypto funds, and enterprise-grade solutions for Web3 startups. Republic Research has played a key role in the success of projects such as Avalanche and Supra, among others. As part of the Republic ecosystem, which has deployed over $2.6 billion across 150 countries, Republic Research is a leader driving innovation in the Web3 space.

Republic Research collaborates with the most promising Web3 projects to drive growth, innovation, and establish a leadership position in the industry. If you're ready to take your venture to the next level, reach out to us today!

Disclaimer

The content of this article is for informational purposes only and should not be considered financial, investment, or legal advice. Investing in cryptocurrency projects involves a high degree of risk, including the potential loss of all invested funds. The views expressed are those of the author and do not necessarily reflect the opinions of Republic. Readers should perform their own due diligence and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Cryptocurrency markets are highly volatile, and regulatory environments are subject to change. Always invest responsibly.