Introduction

On April 2, 2025, President Trump announced a sweeping set of tariffs that would go on to trigger one of the most volatile weeks in global financial markets since the Great Financial Crisis in 2008. Branded by the administration as “Liberation Day,” the move imposed a 10% base tariff on all countries and introduced reciprocal tariffs targeting those with existing levies on American goods.

The shift marked a dramatic escalation in global trade policy and sent shockwaves through markets around the world. But while traditional assets buckled under the weight of geopolitical uncertainty, Bitcoin delivered a powerful message—demonstrating resilience in the face of geopolitical uncertainty.

Against the backdrop of rising economic tensions, Bitcoin didn’t just survive—it showed surprising strength that left even seasoned investors surprised.

In this blog, we’ll unpack the mechanics behind tariffs, why they’ve returned to the global stage, and how they’ve reshaped the investing landscape—particularly through the lens of Bitcoin’s evolution as a digital store of value.

What Are Tariffs, and Why Do They Matter?

Tariffs are government-imposed taxes on imported goods. Historically, they’ve been used to protect domestic industries, generate revenue, or correct trade imbalances. While they’ve existed for centuries—particularly rising to prominence during the early industrial era—their role in modern economics has evolved.

Today, tariffs aren’t just about economics; they’re also wielded as geopolitical tools. Nations use them to apply pressure, signal strength, or retaliate in disputes over trade and sovereignty. In recent decades, global trade trended toward liberalization, with lower tariffs and multilateral agreements paving the way for more open markets dominating economic policy. But President Trump’s latest move marked a sharp reversal, reigniting protectionism on a scale unseen in decades.

Unlike previous trade moves that targeted specific industries or countries, these tariffs were broad, steep, and immediate. The sudden shift disrupted markets worldwide and signaled a new era of trade brinkmanship.

Trump’s Tariff Strategy: A Shock to the System

Trump’s new tariffs weren’t subtle. They were sweeping, sudden, and unapologetically aggressive.

President Trump's 2025 “Liberation Day” tariffs marked a bold and controversial return to protectionist policy. He introduced a 10% base tariff on all countries and steep reciprocal tariffs, particularly targeting China, where the total hit 54% initially—the beginning of what would later escalate in one of the most dramatic trade offensives in modern history.

As of the time of writing, tariff tensions between the US and China remain high, with the US tariff on Chinese goods rising from 54% to 245%, while China’s tariff on US imports has climbed from 34% to 84%, and then to 125%.

So, what was the rationale behind the move? Five clear reasons were laid out:

Fairer Trade Terms – “Our country has been looted… pillaged… and plundered by nations near and far,” Trump claimed, positioning the tariffs as a necessary correction to decades of trade imbalance.

Reviving Domestic Industry – “Jobs and factories will come roaring back” presenting the tariffs as a catalyst for American reindustrialization.

Taking a Stand Against China – “They were taking tremendous advantage of us,” Trump asserted, directly naming China as a primary target.

Reducing the National Debt – Tariff revenue, he argued, would help pay down national debt and cut taxes.

Lowering Consumer Prices Over Time – Through reshoring and renewed domestic competition, he predicted “a golden age of America” with ultimately lower prices for consumers.

The Market Fallout: Trillions Lost in Days

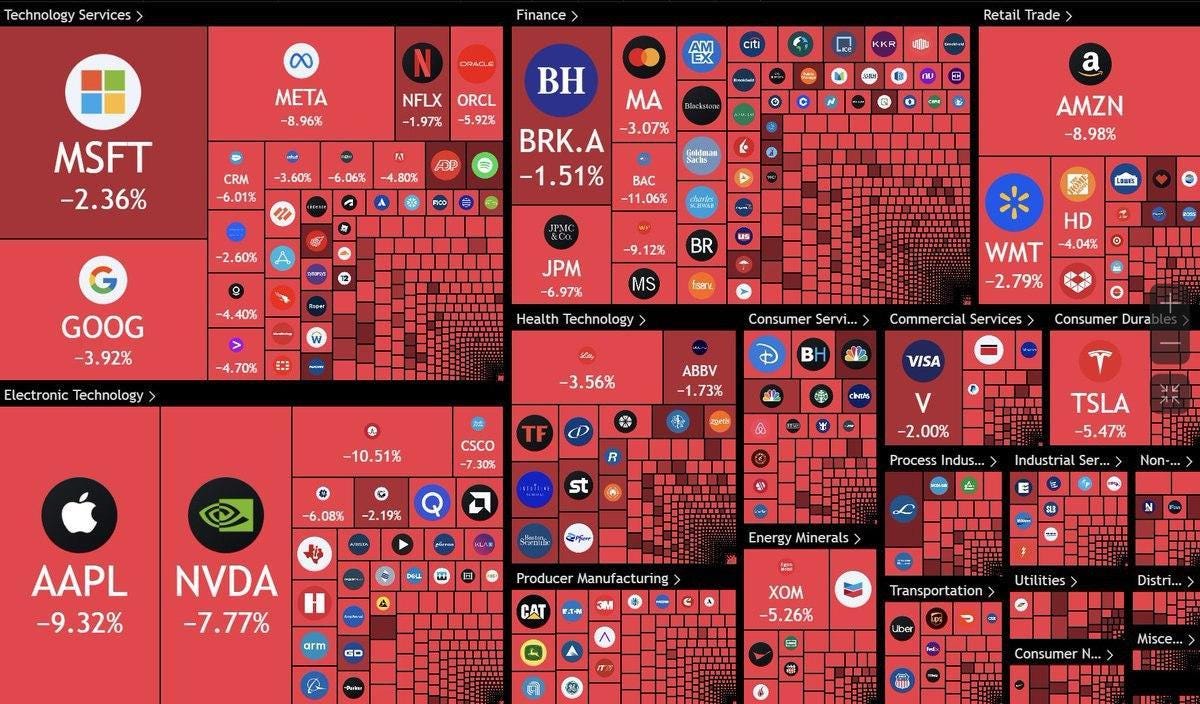

Markets reacted with immediate and sharp declines following the announcement of the ‘tariff war,’ reflecting widespread investor concern over escalating trade tensions. By April 3, over $2.85 trillion was wiped out in a single trading day—the worst in four years.

By April 4, China struck back with 34% tariffs on U.S. goods, triggering an additional $3.25 trillion in losses. And by April 7, more chaos hit all markets. The S&P 500 officially entered bear market territory, falling 21.25% from its highs. In total, more than $10 trillion in market value had evaporated in under a week.

Bond markets also felt the impact, with yields moving sharply as investors reacted to the heightened uncertainty. For instance, yields on 30-year U.S. treasuries jumped 12 bps to 4.835% the biggest 3-day jump since 1982, signaling deep investor anxiety and rising expectations of long-term inflation or instability.

By April 9, the entire escalation reached new heights. China’s tariffs had surged to 84% on U.S. imports. In response, Trump hit back with a staggering 125% tariff on Chinese goods.

So what looked like a geo-political tool was quickly turned into a full-blown trade war morphed into full-scale economic warfare. Leading to an even more pronounced market uncertainty.

Underscored by the volatility index (VIX)—Wall Street’s so-called “fear gauge”—soared past 60, its highest closing level since the 2020 COVID crash.

And, Wall street, where JPMorgan called the tariff package the largest U.S. tax hike since 1968, and projected a 60% chance of recession within the year.

Despite the chaos, a surprising countertrend emerged, namely, retail investors poured $4.7 billion into the market—marking the largest daily inflow in a decade.

It was a striking contrast: institutional players were running for cover, while everyday investors saw an opportunity.

Bitcoin: Volatile, But Resilient?

While global stock markets were in freefall, Bitcoin—typically known for its volatility—showed a surprising level of resilience.

At first, the leading cryptocurrency wasn’t immune to the macro panic. By April 6, Bitcoin fell below $78,000, and by April 7, it had dipped under $75,000—its lowest point during the crisis.

Despite the $200 million in crypto liquidations that hit the market— all within a matter of 60 minutes—Bitcoin began rebounding quickly.

To sum it up, while U.S. equities experienced their sharpest drop since 1957, Bitcoin saw a decline of about 15.8%—falling from a peak of around $88,400 on April 2 to a low of $74,400 on April 7. However, it bounced back quickly, at a pace so impressive that even veteran crypto investors found it remarkable, as shown in the chart below.

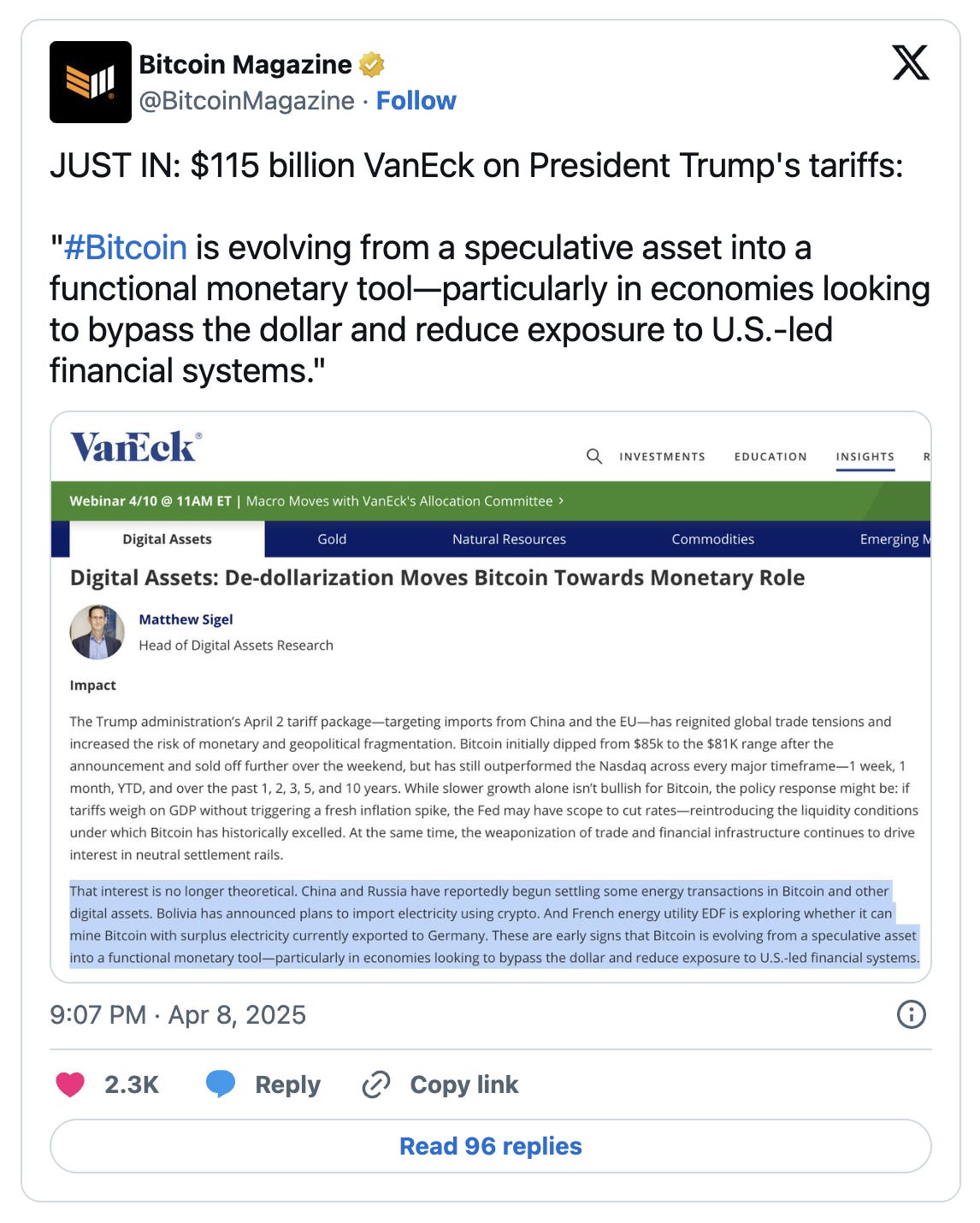

However, this resilience doesn’t seem to be just technical but rather narrative-driven. According to VanEck’s Matthew Sigel, Bitcoin is “evolving from a speculative asset into a functional monetary tool.”

And that evolution was on full display, marked by both China and Russia cross-border transaction settlement in Bitcoin. Signaling not only its rising utility in bypassing traditional financial systems but also a bold step that underscored its growing geopolitical relevance.

Negotiations and the Political Fallout

Despite the turbulence, Trump’s aggressive tariff strategy did move the diplomatic needle. By April 6, more than 50 entities, including India, Vietnam, and European Union, to name a few, had reached out to open negotiations for new trade agreements. That number ballooned to 130 countries by April 13, according to the White House.

Still, the administration held firm. Commerce Secretary Howard Lutnick doubled down, stating: “The President needs to reset global trade,” and promising the return of “trillions of dollars of factories” to U.S. soil.

But while diplomacy picked up, the trade war with China escalated further.

China raised tariffs on U.S. goods to 84%, then 125%.

Trump initially imposed a 125% tariff on Chinese imports, and by April 16, this had soared to a staggering 245%.

Noteworthy, it wasn’t just the U.S. and crypto markets that were affected, the ripples traveled across continents. China’s yuan for example, hit a two-year low, while major Asian markets—like Singapore’s—suffered their worst crashes in over 16 years

And so, what began as a tariff maneuver had quickly spiraled into a full-blown global standoff—testing not just economies, but diplomatic resolve.

A 90-Day Pause: Relief or Reboot?

With all the damage done and continuing to spread like wildfire, on April 9, the White House announced a 90-day pause on most tariffs, signaling a temporary de-escalation and dialing down the market tension—but notably excluding China from the freeze. The impact was immediate. Markets erupted in one of the most euphoric trading sessions in recent memory: $5.5 trillion was added back into U.S. markets

Bitcoin, on the other hand, surged past $80,000, and at the time of writing, it is still holding well above $84,000. And, Wall Street marked its busiest trading day in 18 years, with over 30 billion shares changing hands.

However, while this pause provided breathing room, it remains a temporary relief—the fundamental tensions, especially with China, are still unresolved. And with both sides digging in, the next 90 days may determine whether this was a turning point… or just a calm before the next storm.

Conclusion: A Stress Test with a Clear Signal

There’s no question that President Trump’s aggressive tariff strategy has shaken the foundations of the global economy. Whether it ultimately delivers on promises of revitalized industry, stronger trade deals, and a more powerful U.S. dollar remains to be seen. What is clear, however, is how the financial world responded—and how Bitcoin quietly stood apart. While equity markets erased over $10 trillion and volatility soared, Bitcoin proved remarkably resilient, briefly dipping to $74,000 before recovering above $83,000. In doing so, it reinforced its narrative as a hedge against instability and arguably a tool for long-term monetary preservation.

The coming months will test whether Bitcoin’s strength can hold—and whether it can truly decouple from traditional markets. But as global power balances shift and economic tools evolve, Bitcoin’s role in the future of finance is becoming harder to ignore. So, if this was a stress test, Bitcoin didn’t just survive—it held its ground. And in doing so, it may have offered a glimpse into its next chapter.

About Republic

Republic accelerates the growth of Web3 by supporting the industry’s most ambitious projects and investors. With a world-class team of strategists, the Republic Research arm guides projects from seed to liquidity, offering expertise in tokenomics, smart contract development, fundraising, and marketing. Its platform also includes global token offerings, institutional crypto funds, and enterprise-grade solutions for Web3 startups. Republic Research has played a key role in the success of projects such as Avalanche and Supra, among others. As part of the Republic ecosystem, which has deployed over $2.6 billion across 150 countries, Republic Research is a leader driving innovation in the Web3 space.

Republic Research collaborates with the most promising Web3 projects to drive growth, innovation, and establish a leadership position in the industry. If you're ready to take your venture to the next level, reach out to us today!

Disclaimer

The content of this article is for informational purposes only and should not be considered financial, investment, or legal advice. Investing in cryptocurrency projects involves a high degree of risk, including the potential loss of all invested funds. The views expressed are those of the author and do not necessarily reflect the opinions of Republic. Readers should perform their own due diligence and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Cryptocurrency markets are highly volatile, and regulatory environments are subject to change. Always invest responsibly.