Introduction: What Are ETFs?

Exchange-traded funds (ETFs) are investment products that trade on stock exchanges like regular stocks. While some ETFs hold a diversified mix of assets—such as stocks, bonds, commodities, or currencies—many ETFs focus on a single asset or asset class (for example, the IBIT ETF holds only Bitcoin).

ETFs are popular for their diversification, lower fees, and ease of trading. They often track specific sectors, indexes, or asset classes. While generally efficient and accessible, ETFs can still carry risks related to market volatility, fund structure, or taxation.

In this article, we look at the growing role of ETFs in the crypto space—focusing especially on Bitcoin ETFs and how they’re reshaping access to digital assets, along with a look at Ethereum and other emerging crypto-based ETFs.

What Are Bitcoin ETFs?

Bitcoin ETFs are investment products that allow individuals and institutions to gain exposure to Bitcoin’s price movements—without actually owning or managing the cryptocurrency directly. These are known as spot Bitcoin ETFs because they are backed by real Bitcoin held in custody by the fund.

Bitcoin 101: Understanding the Asset Behind the ETF

Bitcoin–trading at approximately $101,000+ at the time of writing—is a decentralized digital currency that allows users to send and receive value over the internet without relying on a central authority such as a bank or government. Launched in 2009, it was the first cryptocurrency ever created and remains the most widely recognized and valuable today.

Often described as “digital gold,” Bitcoin is known for its fixed supply—only 21 million coins will ever exist. Its underlying technology, the blockchain, is a public ledger that records all transactions in a transparent, tamper-resistant way. This makes Bitcoin both a store of value and a medium of exchange, appealing to both long-term investors and those interested in the broader crypto ecosystem.

In practical terms, a Bitcoin ETF works just like a traditional ETF that tracks assets like the S&P 500 or gold. When investors buy shares of a Bitcoin ETF, the fund issues new shares and typically acquires an equivalent amount of Bitcoin to back those shares, aligning with the purchase demand. By owning shares in the ETF, investors receive a corresponding interest to a portion of Bitcoin held by the fund. The value of ETF shares are designed to move in line with the market price of the underlying asset, such as Bitcoin.

This model provides a simplified, regulated path for investors to participate in the Bitcoin market using familiar financial tools, like brokerage accounts, without the need for digital wallets, private keys, or crypto exchanges.

Currently, Bitcoin ETFs are available in a number of countries, however, the US leads the market, capturing 83% of global spot Bitcoin ETF assets, which totaled more than $35 billion as of early 2024.

Bitcoin ETF Approval: A Turning Point for Crypto

A pivotal moment came on January 10, 2024, when the U.S. Securities and Exchange Commission (SEC) approved 11 spot Bitcoin ETFs in a single decision. Among the approved issuers were major financial players such as BlackRock, Fidelity, Grayscale, Invesco, VanEck, and Bitwise.

Since their launch in early 2024, spot Bitcoin ETFs have seen strong momentum, with early inflows topping $6 billion. While inflows cooled mid-year and briefly turned negative in early 2025, the overall trend has remained positive. Over the past two months, inflows have rebounded, signaling renewed investor confidence. As of May 2025, total ETF assets stand at over $118 billion—reflecting growing institutional participation in the space (see chart below).

The launch of spot Bitcoin ETFs is widely regarded as a landmark moment for the crypto industry—a breakthrough that not only signaled regulatory acceptance but also marked a major step toward the mainstream integration of digital assets within traditional finance. For many, it represents one of the most successful and meaningful bridges between crypto and Wall Street to date.

Bitcoin ETFs: Where Are We Today?

As of May 9, 2025, the growth of Bitcoin ETFs continues to accelerate, as shared by Coinglass Bitcoin ETF Stats data:

Total Assets Under Management (AUM): $120.63 billion

Total Market Capitalization: $123.32 billion

Average Daily Trading Volume: $1.33 billion

In addition to the raw numbers, there’s a clear upward trend in Bitcoin ETF market capitalization as these products mature and gain broader adoption. This continued growth is visually reflected in the market cap chart shown below, highlighting the long-term potential of the space.

One of the most striking developments is the rapid pace of growth. In just three trading days, Bitcoin ETFs saw nearly $1.4 billion in inflows—driving the price from around $85,000 to beyond the $100,000 mark. This surge highlights not just sustained interest but accelerating momentum in the market.

The market leader among these products is BlackRock’s iShares Bitcoin Trust (IBIT), which at the time of writing, holds over 621.60K BTC, valued at more than $64.43 billion.

On April 28, 2025, IBIT recorded $970.9 million in inflows—its second-highest daily total since launch—while rivals like Fidelity’s FBTC and ARK’s ARKB experienced notable outflows.

Overall, this surge in capital and activity signals growing confidence in Bitcoin ETFs and strengthens the argument made by many investors and analysts alike: Bitcoin ETFs are still in their early stages, with substantial room to grow as adoption expands.

Ethereum ETFs: A New Chapter in Crypto Investing

Just like their Bitcoin counterparts, Ethereum ETFs offer investors a way to gain exposure to the price of Ethereum—the world’s second-largest cryptocurrency—within a regulated, traditional investment framework. These funds track the market value of Ethereum without requiring investors to hold, manage, or secure the asset themselves.

Following the success of spot Bitcoin ETFs, Ethereum was the next logical step. In August 2024, the SEC approved eight spot Ethereum ETFs, issued by major asset managers including BlackRock, Fidelity, Grayscale, Bitwise, VanEck, Ark, Invesco Galaxy, and Franklin Templeton.

As of May 9, 2025, Coinglass Ethereum ETF Stats shows the market standing at:

Market Capitalization: $8.39 billion

Total AUM (Assets Under Management): $9.04 billion

Daily Trading Volume: Over $326.11 million

The Next Big Thing: Staking Within Ethereum ETFs

What makes Ethereum ETFs particularly compelling is not just their growth—but the innovation they’re potentially about to unlock: staking.

What is staking?

Staking involves locking up cryptocurrency to help secure a blockchain network that uses a proof-of-stake (PoS) consensus mechanism—like Ethereum. In return, participants earn rewards, typically paid in the same token they stake.

For instance, Ethereum users who stake ETH to validate transactions and support network operations receive additional ETH as compensation.

Several major asset managers, including Grayscale, have submitted proposals to the SEC to allow staking directly within Ethereum ETFs. If approved, this would let investors earn staking rewards—similar to interest—on top of price exposure to ETH, offering both growth and passive income potential.

While the SEC recently delayed decisions on two of Grayscale’s staking-enabled Ethereum ETF proposals, there’s growing optimism. Markets in Canada, Hong Kong, and Europe have already green-lighted staking in ETF structures, setting a precedent. And with the recent appointment of Paul Atkins as SEC Chair—who is viewed as more crypto-friendly—many expect progress in the US to follow sooner rather than later.

Beyond Bitcoin and Ethereum: The Next Wave of Crypto ETFs

While Bitcoin and Ethereum ETFs have captured most of the headlines, they are only the beginning. As the ETF model proves successful in crypto’s two largest assets, demand is growing rapidly for more diversified crypto ETF offerings.

To date, only Bitcoin and Ethereum ETFs have received approval from the SEC. However, a wide range of other cryptocurrency ETFs are now in the pipeline—highlighting growing interest from both investors and issuers.

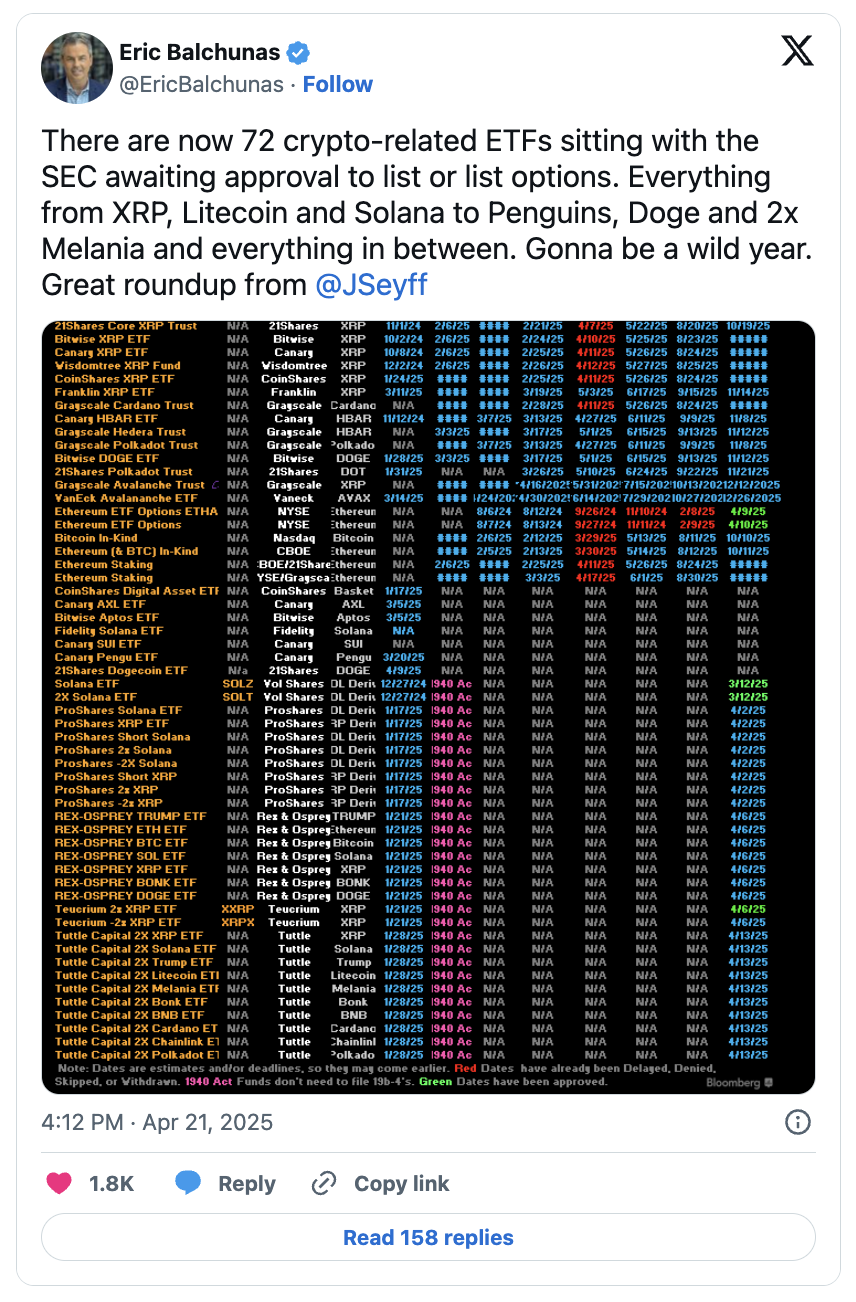

In total, more than 70 crypto ETF proposals are currently under review by the SEC, representing projects like SUI, Solana, TRON, Polkadot, Hedera, and several crypto index products.

Among the most notable pending applications are Solana ($SOL), Ripple ($XRP), and, more recently, a TRON ($TRON) ETF with staking capabilities filed by Canary Capital. Other proposals—such as those for Dogecoin ($DOGE), Polkadot ($DOT) and Hedera ($HBAR)—have already received delays on the SEC’s decision.

With continued activity across ETF filings, it’s evident that the crypto ETF market is in a phase of expansion. Should staking-enabled products gain regulatory approval, they could introduce a broader and more diverse set of digital asset offerings for investors to consider.

The Regulatory Shift Behind Crypto ETF Momentum

Interest in crypto ETFs is rising alongside shifts in both US and global regulatory environments.

In the US—which holds the largest share of the digital asset market—the SEC has recently adopted a more open stance, dropping several lawsuits against crypto firms and initiating public discussions around industry regulation (see our previous article for more). The agency’s new chair, Paul Atkins, has voiced support for digital assets and expressed a desire to collaborate with lawmakers on a formal regulatory framework.

Internationally, countries like South Korea are also moving toward crypto ETF adoption. Its ruling party has pledged to approve spot crypto ETFs and ease banking restrictions if re-elected—just one example of the broader global shift toward regulated digital asset investment.

As regulation evolves, crypto ETFs are becoming a more accessible, compliant gateway for investors—combining traditional finance structures with exposure to digital assets.

Crypto ETFs: Advantages and Trade-Offs

While ETFs offer a streamlined way for investors to gain exposure to cryptocurrency and simplify access, they come with important trade-offs.

✅ Key Advantages

Easy Access: Buy and sell through regular brokerage accounts—no crypto-specific setup required.

Reduced Complexity: No need to manage private keys or navigate crypto wallets.

Regulatory Oversight: ETFs operate under established financial regulations, offering added investor protection.

⚠️ Key Trade-Offs

No Direct Ownership: Investors hold shares in a fund—not the underlying Bitcoin or Ethereum.

Custodial Risk: The crypto is held by a third-party custodian, not the individual investor.

Loss of Decentralization: ETFs conflict with crypto’s self-sovereignty ethos.

Volatility & Fees: Price swings still apply, and ETF fees may affect returns. Tax treatment may also differ from holding crypto directly.

For many investors—especially institutions and newcomers—crypto ETFs provide a secure and convenient entry point. But those who prioritize direct control and decentralization may still prefer to hold the assets themselves.

Final Thoughts: The Evolving Landscape of Crypto ETFs

The rapid rise of Bitcoin and Ethereum ETFs has opened the door to a new era of digital asset investing—one that’s more accessible, regulated, and aligned with traditional financial systems. As regulatory frameworks mature and new products like staking-enabled ETFs emerge, crypto is no longer on the fringe—it’s becoming part of the mainstream investment conversation.

About Republic

Republic accelerates the growth of Web3 by supporting the industry’s most ambitious projects and investors. With a world-class team of strategists, the Republic Research arm guides projects from seed to liquidity, offering expertise in tokenomics, smart contract development, fundraising, and marketing. Its platform also includes global token offerings, institutional crypto funds, and enterprise-grade solutions for Web3 startups. Republic Research has played a key role in the success of projects such as Avalanche and Supra, among others. As part of the Republic ecosystem, which has deployed over $2.6 billion across 150 countries, Republic Research is a leader driving innovation in the Web3 space.

Republic Research collaborates with the most promising Web3 projects to drive growth, innovation, and establish a leadership position in the industry. If you're ready to take your venture to the next level, reach out to us today!

Disclaimer

The content of this article is for informational purposes only and should not be considered financial, investment, or legal advice. Investing in cryptocurrency projects involves a high degree of risk, including the potential loss of all invested funds. The views expressed are those of the author and do not necessarily reflect the opinions of Republic. Readers should perform their own due diligence and consult with a qualified financial advisor before making any investment decisions. Past performance is not indicative of future results. Cryptocurrency markets are highly volatile, and regulatory environments are subject to change. Always invest responsibly.